WE’VE SURVIVED THE PAST ONCE, WASN’T THAT ENOUGH?

Because here we are repeating the past, validating the experience and belief systems from our teen years

- just to end up with adolescent sized bank accounts, pay checks, and debt loads.

APPARENTLY NOT

I’M STEFANIA MARIAA

And despite an entire career in accounting and finance - I was in my late 20s, still facing a half-renovated home with no running water, when I hit my final breaking point.

Exhausted from pretending I had it all together, I was forced to face the messy truths I'd been hiding from for years: I was a bit of an intensity junkie.

Life had to be HARD.

Life had to be COMPLEX.

And the idea that it could be easy? Pfft. That was for the rich kids.

That's when I realized my teenage-self was running rogue with my wallet. Trying to throw money at any problem, without questioning why the problem even existed.

Well guess what honey, my teenage self isn’t the one running ship; I’m the captain now.

And I will NOT be reliving the life I was raised in.

Don’t get me wrong. As a teen, I had life all figured out.

I knew which boxes needed to checked to finally change the colour of my collar.

✔️ University ✔️ Killer Career ✔️ Bomb-Ass Network ✔️ Retirement Fund ✔️so on…

But the reality was, I had no idea what real responsibility looked like; let alone how to respect my self in the process.

I was constantly on the brink of a breakdown, burnt out, and feeling like I was always behind. But I just had to prove myself.

To my boss, to my parents, to my friends…

In turn, I was too busy trying obey to rules to freedom - that I’d unwillingly accept sacrificing my heart and soul for it.

That was until I realized how much disrespect teenaged-me was willing to tolerate under the premise that I’d “survive it anyways”

But here’s the thing….

BEING GOOD AT SURVIVAL ISN’T A BADGE OF HONOR.

Its a regression to a past you’ve already lived once - and don’t need to relive again.

You’ve never heard someone talk about money like I do.

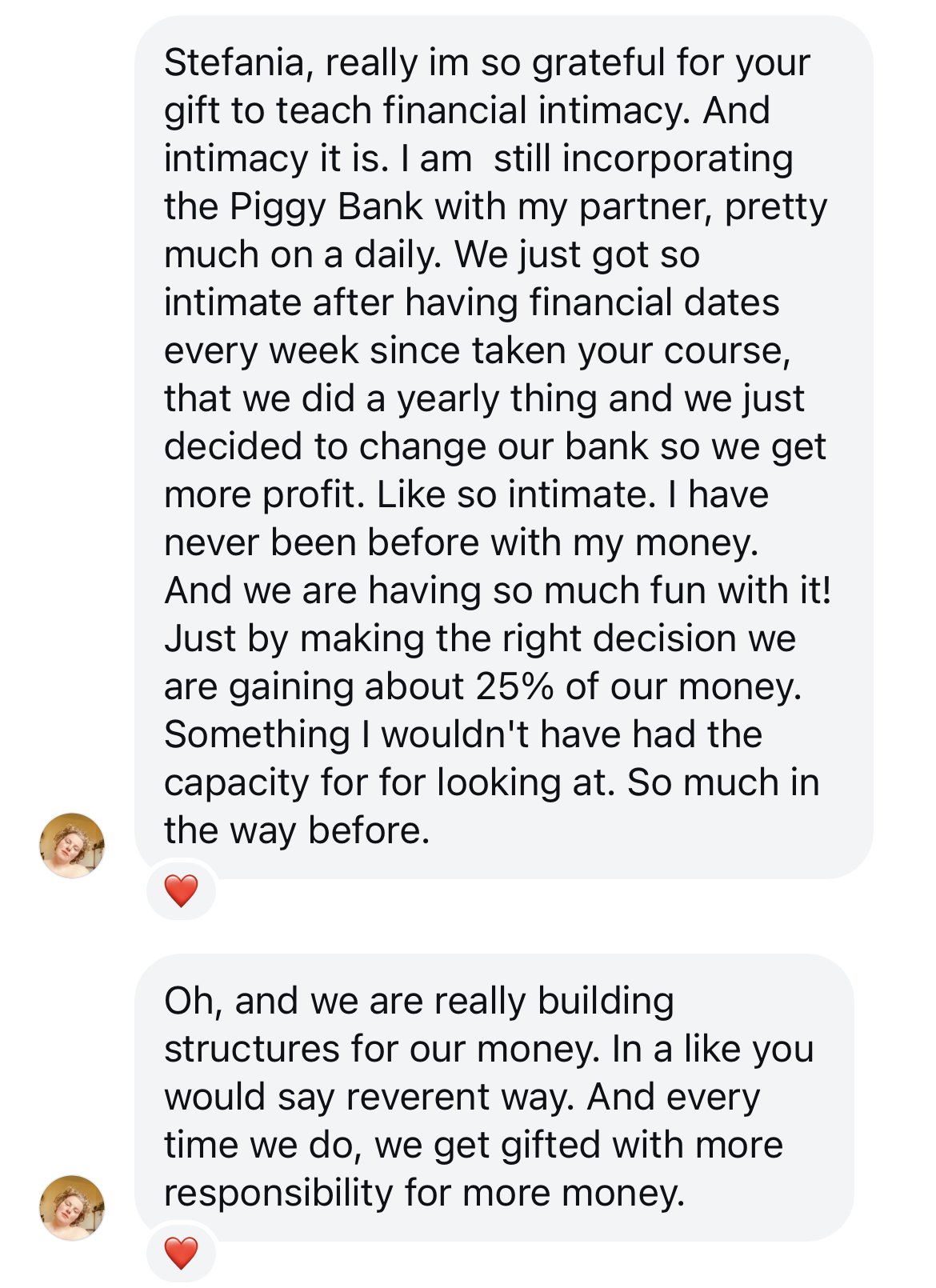

Financial Intimacy is the practice of becoming radically honest with yourself about your patterns, behaviours, and orientations to wealth. It is a complete paradigm shift for those of us who want to feel powerful when it comes to our lives, and the resources that flow with in it.

But it can also feel super overwhelming if you’ve never look at your money as an extension of your self-respect.

Inside The Piggy BANK, our intention is to create the basic practices of Reverence & Responsibility that leave you confident to address ANY financial reality, while never having to sacrifice any part of you in the process.

Inside The Piggy Bank

YOU’LL GET

ACCESS TO:

4 Iconic Modules delivered through a Private Podcast Feed

4 downloadable workbooks to bring financial intimacy to your expenses, income, savings, and debt

ARE YOU READY?

Grab your headphones, hit play, and step into the world of Financial Intimacy

💰 4 Iconic modules

💰 Delivered via private podcast feed

💰So your inner teen can chill the fcuk out.

NOTE: You will be redirected to add The Piggy BANK to your favourite podcast player after your purchase.

IS FINANCIAL INTIMACY the same as Financial Advice?

Turns out I needed to put this disclaimer on to not upset some people over on threads. But No. Financial Intimacy IS NOT Financial Advice. Not even remotely. In fact, I will actively avoid telling you what to do with your money. Because it isn’t my money. It’s YOURS.

So, I will not advise on investments, arrange deals, or manage your money. I will not tell you what to do, how to do it, or where to put it.

Financial Intimacy is a PRACTICE of learning who you are in the face of those things, and WTF to do about it. How to approach your resource allocation from internal rightness and clarity, not oursourcing your choices to anyone just because they have a “expert” title. Being financially intimate, is YOU knowing your finances. In fact, you never have to tell me a damn thing about them.